Can investing be a hobby?

Yes, investing can be a hobby. But not always.

A common and trendy myth in the stock market is that investing in stocks can be perceived as a hobby, and maintaining a stock portfolio consumes just a few hours a month. This belief benefits Wall Street and the entire financial industry, from financial bloggers and course writers to brokers who earn commissions on trades.

Where’s the caveat?

Stock picking requires an investor to dedicate lots of time to:

- consuming information and analytics

- studying fundamental and technical analysis

- opening and closing deals more often

As a result, they provide income to the entire industry. But, unfortunately, usually at their own expense.

Why is it hard to beat the market?

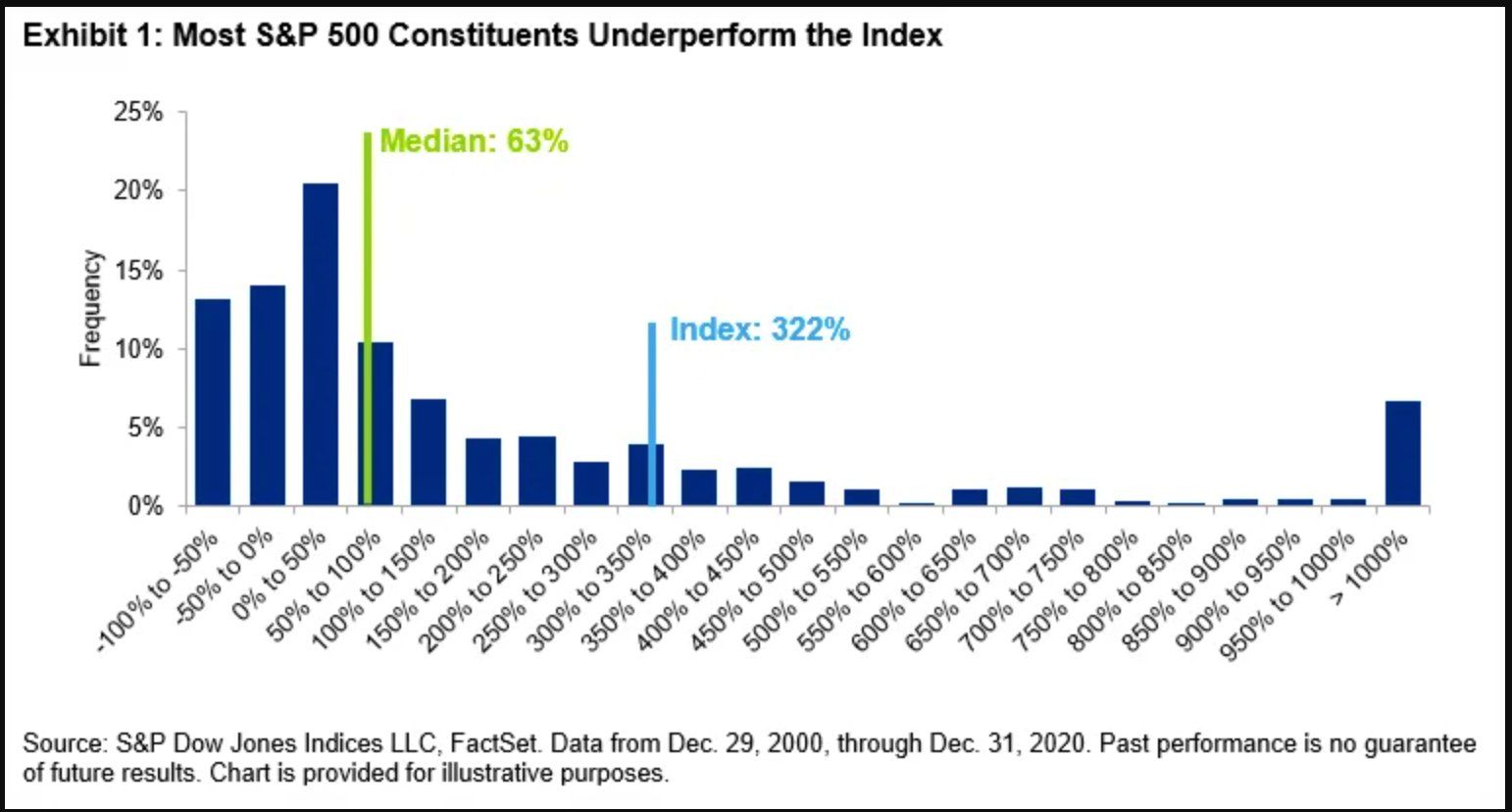

According to S&P Dow Jones Indices, only 22% of S&P 500 stocks outperformed this index from 2000 to 2020. During this study period, the S&P 500 rose 322%, while each individual stock rose an average of just 63%. You can see it clearly in the graph:

Thus, to beat the market, you need to be smart enough to pick that 22% of companies from, let’s say, the 500 companies of the S&P 500. The necessary competencies and the time required to do this diligently exceed what could be called “a hobby” to a great extent.

What do you need to know to beat the market?

The list is long. You need to understand the following:

- macroeconomics

- the interdependence of monetary conditions

- inflation and company valuations

- composition of fixed and variable costs

- importance and role of technologies and patents used

- dependence of business on macro conditions and economic cycles

- economic indicators and their changes

- business conditions in target regions

And if you want to outperform the market by doing it smart, not just gambling and hoping that luck will be on your side, the list goes on and on.

What else do you need to know?

Now to the competencies listed above, you need to add the regular tasks like:

- reading reports and analyzing them every quarter (this can be up to several dozen pages of technical text)

- listening to quarterly and annual conferences with company management

- building mathematical models based on all this information that discount the company’s financial indicators and estimate the forecasted earnings per share in the future

- research the analysis and models performed by other analysts, see what factors they take into account, incorporate them into your own analysis with thought and critical approach, and make adjustments if necessary

And if this list didn’t frighten you so far and you’re still on it, here’s one more thing: all of the above applies not only to the company you are planning to invest in but also to all its competitors. If you skip an essential patent or competitor’s information, you will probably lose 30–50% of the stock price.

Let’s say you made it to the moment when you know exactly what to buy and at what price. Are we done now?

Not yet. Hold your horses! At this stage, there are more competencies to have: an understanding of how to use options to buy company shares more profitably with an option premium, as well as determine the minimum capital to buy 100 shares of the company, taking into account the diversification.

And now, let’s stay on top of the market changes! Because tomorrow everything could change, and all your calculations, thoughts, and plans will be in vain. That’s how stock picking works (or doesn’t work for most of us).

Sounds like more than just a hobby, right?

But you don’t need to go through all the above to become an investor. There is an easier way.

What to do, then?

John Bogle, the legendary founder of the Vanguard Group, once said:

“Buy a haystack, not a needle.”

That’s exactly what you need to do to gain profit from investing while not making it your full-time job.

ETF is the solution. And make it a long-term investment.

Very often, buying all 500 stocks in the form of an ETF will be much more profitable than trying to capture the 22% that outperforms the market. But it is also worth remembering about geographical diversification and not focusing only on the US market. Dark times happen there, also.

What if I still want to invest in companies?

Not only the market wants us to invest in stocks. Our brain and psychology are not on our side either.

As practice shows, not everyone succeeds in long-term disciplined investing in ETFs. This is an expected irrationality. Sooner or later, investors want to test their hypotheses and assumptions. Therefore, the idea is to have the main portfolio where 90% of the assets are in ETFs, and 10% is there for fun and experiments where you can invest in individual companies. This approach is the most sustainable and optimal in the long term.

Let’s sum it up

Can investing only in stocks be a hobby?

No.

How to make investing a hobby but still gain profit?

Split your portfolio into 90% for ETFs and 10% for experimenting with companies’ stocks.

About the author

Vasyl Matiy is the Head of investment experience at Bakksy. He has ten years of experience in banking, investment, and asset management. Vasyl is also a portfolio manager of multi-family office, UHNWI consultant, financial wellbeing corporate trainer for digital companies, public speaker and columnist.